All Categories

Featured

Table of Contents

Any kind of staying excess belongs to the owner of document right away before the end of the redemption duration to be claimed or appointed according to legislation - tax lien. These sums are payable ninety days after execution of the deed unless a judicial action is set up during that time by another complaintant. If neither asserted neither appointed within 5 years of day of public auction tax obligation sale, the overage shall escheat to the general fund of the controling body

386, Areas 44, 49.C, eff June 14, 2006. Code Commissioner's Note 1997 Act No. 34, Section 1, directed the Code Commissioner to alter all recommendations to "Register of Mesne Conveyances" to "Register of Deeds" any place appearing in the 1976 Code of Regulations.

What Are The Top Features Of Property Overages Courses?

201, Component II, Section 49; 1993 Act No. 181, Area 231. AREA 12-51-140. Notice to mortgagees. The arrangements of Areas 12-49-1110 with 12-49-1290, comprehensive, connecting to observe to mortgagees of recommended tax sales and of tax obligation sales of residential properties covered by their respective home loans are taken on as a part of this chapter.

Code Commissioner's Note At the direction of the Code Commissioner, "Sections 12-49-1110 with 12-49-1290" was replacemented for "Areas 12-49-210 via 12-49-300" due to the fact that the last sections were reversed. SECTION 12-51-150. Authorities may invalidate tax sales. If the authorities accountable of the tax obligation sale finds before a tax obligation title has actually passed that there is a failure of any kind of action called for to be appropriately executed, the authorities may nullify the tax sale and reimbursement the quantity paid, plus passion in the amount actually gained by the region on the amount reimbursed, to the effective prospective buyer.

HISTORY: 1962 Code Section 65-2815.14; 1971 (57) 499; 1985 Act No. 166, Area 14; 2006 Act No. 386, Areas 35, 49. Code Commissioner's Note At the direction of the Code Commissioner, the very first sentence as amended by Section 49.

HISTORY: 1962 Code Section 65-2815.15; 1971 (57) 499; 1985 Act No. 166, Section 15; 2006 Act No. 238, Section 3. B, eff March 15, 2006. AREA 12-51-170. Contract with county for collection of taxes due municipality. A region and community might acquire for the collection of local tax obligations by the region.

Which Learning Resource Is Most Effective For Successful Investing?

He might utilize, designate, or mark others to carry out or lug out the arrangements of the chapter. HISTORY: 1962 Code Area 65-2815.16; 1971 (57) 499; 1985 Act No. 166, Section 16.

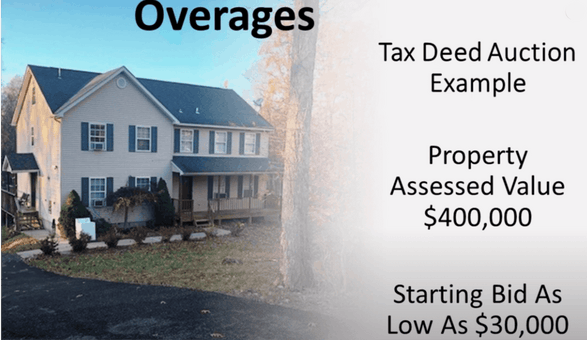

Tax liens and tax obligation deeds commonly offer for greater than the area's asking rate at public auctions. Furthermore, the majority of states have legislations influencing bids that go beyond the opening proposal. Repayments above the county's criteria are called tax sale excess and can be rewarding financial investments. The information on overages can develop issues if you aren't conscious of them.

In this write-up we inform you exactly how to get lists of tax obligation overages and earn money on these properties. Tax sale excess, also referred to as excess funds or premium quotes, are the amounts bid over the beginning rate at a tax auction. The term describes the dollars the capitalist spends when bidding process over the opening bid.

What Is The Most Valuable Training For Real Estate Training Investors?

The $40,000 boost over the initial bid is the tax sale excess. Asserting tax sale overages means acquiring the excess money paid throughout an auction.

That stated, tax obligation sale overage cases have shared characteristics throughout a lot of states. Throughout this duration, previous owners and home mortgage holders can contact the county and obtain the overage.

What Is The Most Effective Way To Learn About Financial Freedom?

If the period expires before any kind of interested parties assert the tax sale overage, the county or state typically takes in the funds. Previous owners are on a strict timeline to insurance claim excess on their homes.

Remember, your state laws influence tax obligation sale overages, so your state might not permit investors to accumulate overage passion, such as Colorado. Nonetheless, in states like Texas and Georgia, you'll earn interest on your entire proposal. While this aspect doesn't suggest you can assert the overage, it does help reduce your expenditures when you bid high.

Remember, it might not be lawful in your state, meaning you're restricted to accumulating passion on the excess - property overages. As mentioned over, a capitalist can discover means to make money from tax sale excess. Due to the fact that interest revenue can relate to your whole quote and past proprietors can assert excess, you can utilize your understanding and tools in these situations to make best use of returns

A vital element to keep in mind with tax sale excess is that in many states, you only require to pay the county 20% of your complete proposal up front., have laws that go past this guideline, so once again, research study your state legislations.

What Are The Key Benefits Of Taking An Foreclosure Overages Course?

Instead, you just need 20% of the quote. If the residential property doesn't retrieve at the end of the redemption period, you'll need the staying 80% to obtain the tax obligation deed. Because you pay 20% of your bid, you can make interest on an overage without paying the full price.

Again, if it's legal in your state and region, you can deal with them to help them recoup overage funds for an extra fee. So, you can accumulate rate of interest on an overage quote and bill a fee to streamline the overage case procedure for the previous owner. Tax Sale Resources recently released a tax obligation sale overages item particularly for individuals thinking about seeking the overage collection service.

Overage collection agencies can filter by state, county, property type, minimum overage quantity, and maximum overage amount. As soon as the data has actually been filteringed system the collectors can determine if they wish to add the skip traced data plan to their leads, and after that spend for just the confirmed leads that were found.

Training

To obtain started with this game changing item, you can find out much more below. The best way to get tax obligation sale excess leads Concentrating on tax obligation sale excess as opposed to traditional tax obligation lien and tax deed spending needs a specific approach. Furthermore, just like any type of various other investment method, it offers distinct pros and disadvantages.

Table of Contents

Latest Posts

Unclaimed Tax Overages

Tax Lien Investing Basics

Profit By Investing In Tax Liens

More

Latest Posts

Unclaimed Tax Overages

Tax Lien Investing Basics

Profit By Investing In Tax Liens